What We’re Thinking About in Impact for 2026

January 21, 2026 BlogThe education sector is navigating a fundamental shift. Market forces are driving consolidation, capital is more selective, and…

As the notion of “school” and “good education” continue to evolve, the flow of money from state governments is also undergoing a potentially significant transition. The spotlight is on the ascent of Education Savings Accounts (ESAs), which allocate a portion of state funds designated for a child’s public school education into a specialized account controlled by parents.

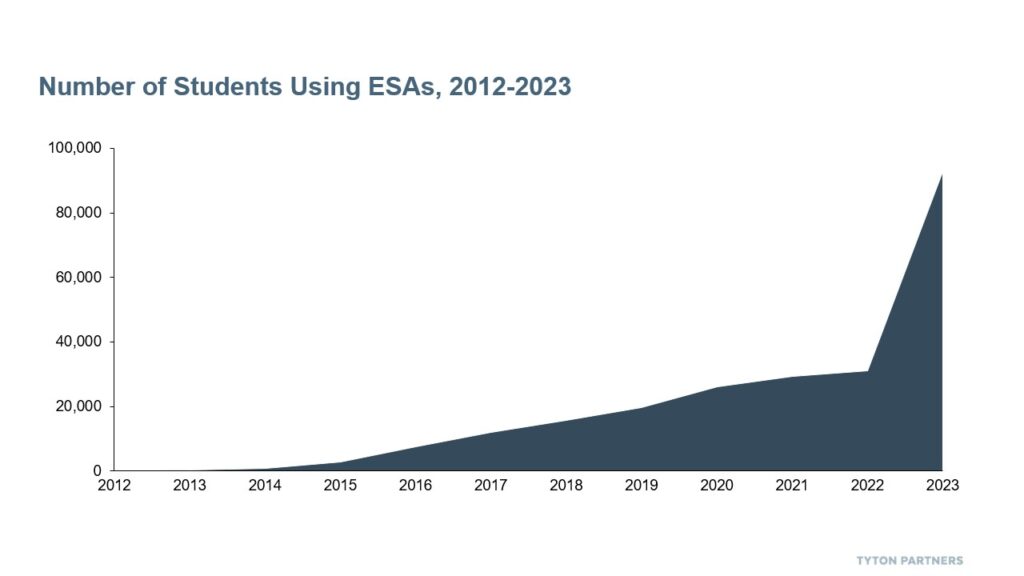

Last year alone, more than 92,000 students participated in ESA programs nationwide. With states spending ~$7,430 per student, that results in approximately $680 million in funding that left the K-12 public school system during the 2023-2024 school year (or roughly 1% of total federal, state, and local government spending on the U.S. K-12 public education system).

In this newsletter, we delve into the significance of ESAs, exploring their origins, growth, and the far-reaching impact they may have on suppliers selling into K-12 districts, innovative organizations offering alternative student education programs and pathways, and the services and technologies that support these schools and providers.

The school-choice movement has evolved from tuition vouchers to tax-credit scholarships (TCS) to the newest flavor of choice: ESAs. Combined, ~770k students participated in these three program types in 2022-2023, with ESAs rapidly gaining prominence and outpacing the growth of the other choice programs – between the 2021-22 and 2022-23 school years, participation in ESA programs nearly tripled.

The concept of ESAs originated in Arizona in 2011, and was designed to give parents a greater level of flexibility over their child’s education relative to vouchers and tax credits. Unlike traditional vouchers and TCS that were reserved for school tuition fees, parents are permitted to use their ESA accounts on a variety of education-related products and services, including and beyond tuition; such as tutoring, instructional programs and materials, extra-curricular activities, and in some cases, college.

Since being introduced in Arizona, ESAs have been enacted in 12 additional states; in six states, the programs provide universal eligibility, meaning every student in the state can elect to participate regardless of income, race, or local public school quality. With an average spending of $7,000 per student, the total addressable market (TAM) for students already eligible for ESAs is $71.4 billion. It is expected to grow as more states introduce ESAs and universal eligibility. In Tyton’s upcoming research on ESAs, Paying for Choice 2024, we found that 10.2 million students are currently eligible for ESA participation. Stay tuned for the report, which will be released this Spring.

The surge in ESA participation presents challenges and opportunities for providers that serve K-12 districts. Public school districts are grappling with an immediate need to innovate their approach, facing increased competition from non-traditional providers that is shrinking enrollment and driving correlated funding gaps. Areas of near-term focus to ‘defend’ against emerging educational options include enhancing customer service for parents, standing up fully online and virtual programs that can serve as in-district alternatives, and offering more personalized and customized learning experiences that serve the pandemic-accelerated need for increased flexibility and support. Savvas’ recent acquisition of Outlier, which created a portfolio of turnkey, online college-level courses that allow high school students to earn college credit without leaving their school building, points to the importance of tailoring educational experiences based on individual student need.

Beyond pressures to improve school-home engagement and academic flexibility, the necessity for public schools to address the needs of the ‘whole’ child remains a significant priority. In Part 1 of Choose to Learn 2024, we found that mental health and social-emotional concerns are driving many parents to consider ‘taking action’ and leave their child’s public system if not adequately addressed by their local school. Organizations that can support districts in addressing both academic and mental health and well-being needs of students should find favor with districts as families’ school choice options expand. One manifestation of this dynamic is in districts’ increasing embrace of mult-tiered systems of support (MTSS), an approach that identifies interventions for students across academic, social-emotional, and behavioral areas. Innovative platform providers that help districts take a data-driven approach to MTSS are emerging, as exemplified by Bain Capital Double Impact’s recent investment in Branching Minds.

Districts can also ‘defend’ against churn by capitalizing on their strengths, emphasizing the social and extracurricular aspects of schooling (e.g., sports, music programs, after-school programs) that parents value and that many alternative school providers may lack the resources to offer. Marketing and expanding offerings in these areas can help districts retain their appeal in the face of growing competition. Conversely, third-party companies and organizations that offer extracurricular activities to parents outside of the public school system may benefit from the flexibility of ESA approved uses, and represent a growing investment opportunity directly adjacent to the school setting.

The availability of ESAs has made private school options accessible to a broader demographic, shrinking and in some cases eliminating the ‘out of pocket’ costs typically associated with non-public school alternatives. The pent-up demand for previously unattainable private schooling is expected to drive a significant shift in the B2C alternative education space.

Innovative school models, such as micro-schools, homeschooling services, virtual schools, and supplemental educational experiences stand to benefit from the maturation of ESA programs. In 2022, Prenda raised $20M to help pivot its model and focus on catalyzing an ecoystem of K-8 microschools. Higher Ground Education, MyTechHigh, Primer, KaiPod Learning, and similar companies, that are striving to create, scale, and power innovative school models and education experiences for students, are expected to satisfy increased demand from parents and drive interest from investors. As ESAs evolve, new models may emerge or accelerate, offering diverse educational opportunities to students and inviting investors to a fast-growing segment of the education market.

The actual distribution of ESA funds poses a substantial challenge for states, parents, and program providers. In fact, one of the primary risks to the ESA program in its infancy has been ensuring that parents have access to the funds when they need them (or get reimbursed shortly thereafter) and that providers receive payment in a timely fashion. This creates an opportunity for technology platforms like ClassWallet and Odyssey, who manage and support the complex process of distributing funds on behalf of states’ ESA program administrators. Recent funding raises, such as ClassWallet’s $95 million round, indicate the growing significance of these platforms in managing fund distribution for state and local government agencies.

Another logistics-related dynamic, transportation, becomes crucial for parents and students who seek to enroll in programs that may be more distant than their local public school. Companies that are addressing these barriers and enabling more efficient transportation solutions are poised to capitalize on this need. Zum, which recently secured a $140 million series E, is one example of this, as are innovators like HopSkipDrive, EverDriven, 4Mativ, and MyShule. Investors should expect providers that more directly serve non-traditional schools to enter the space in order to satisfy the unmet transportation needs of ESA families and capture a share of these ESA dollars.

In the midst of this educational evolution, ESAs are unlocking new possibilities, reshaping the dynamics of school choice, and putting pressure on public K-12 systems in potentially profound ways. The scale of the spending shift that may occur in states with these programs could create a tidal wave, washing away some programs and models and while simultaneously launching others to unanticipated heights. As the ESSER waves start to recede, states’ ESA programs may offer new ones to ride.

Update: We published a three-part series on ESAs, Paying for Choice 2024. It draws on feedback from more than 1,200 parents in Arizona and Florida – two of the largest and most “mature“ ESA states – and nearly 200 companies and organizations actively delivering ESA-eligible programs and services. Learn more about Paying for Choice 2024 here.